EU-ETS Reform: A Challenge for European Industries

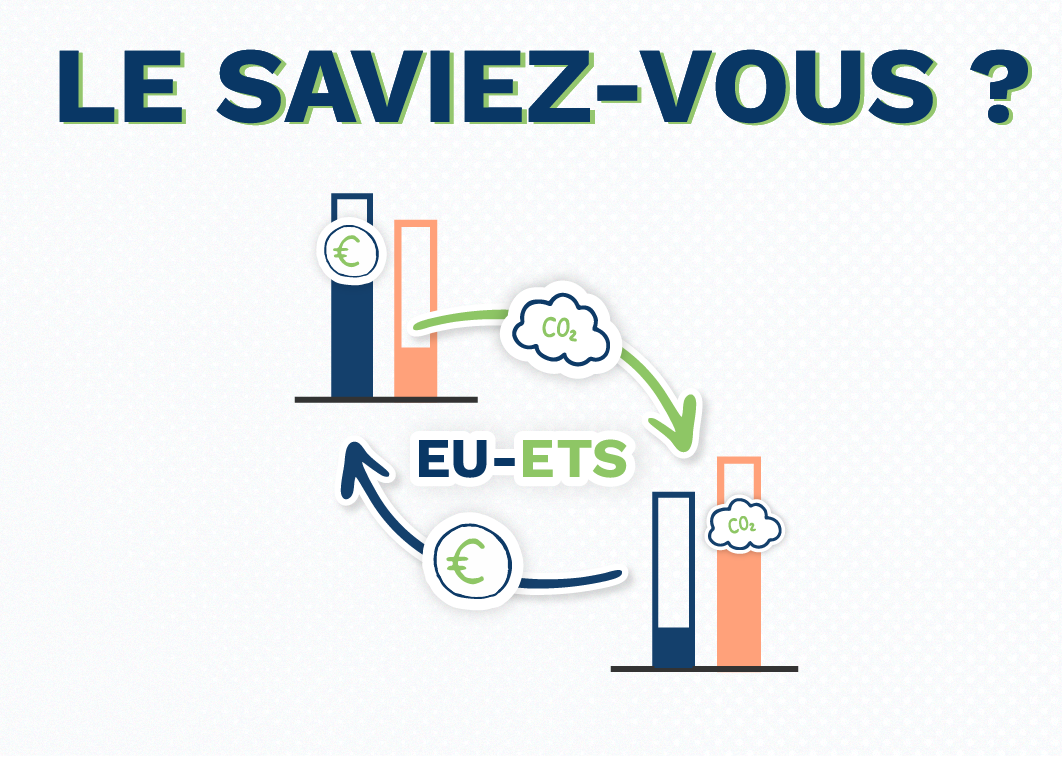

A carbon market based on the polluter-pays principle

As part of its decarbonization ambition, the EU adopted the Emissions Trading System (EU ETS) as early as 2005. The principle is simple: charge the main greenhouse gas emitters to encourage them to reduce their emissions.

This system applies to the highest-emitting industries, particularly electricity production, energy-intensive industries (such as oil refining, steel, paper, glass, and cement production), commercial aviation for flights within Europe, and, since 2024, maritime transport (within the EU and departures and/or arrivals at a European port). All EU member states are involved, as well as Iceland, Norway, the United Kingdom, and Switzerland.

€70/tonne

The spot price of CO2 – in June 2024

Source : European Commission

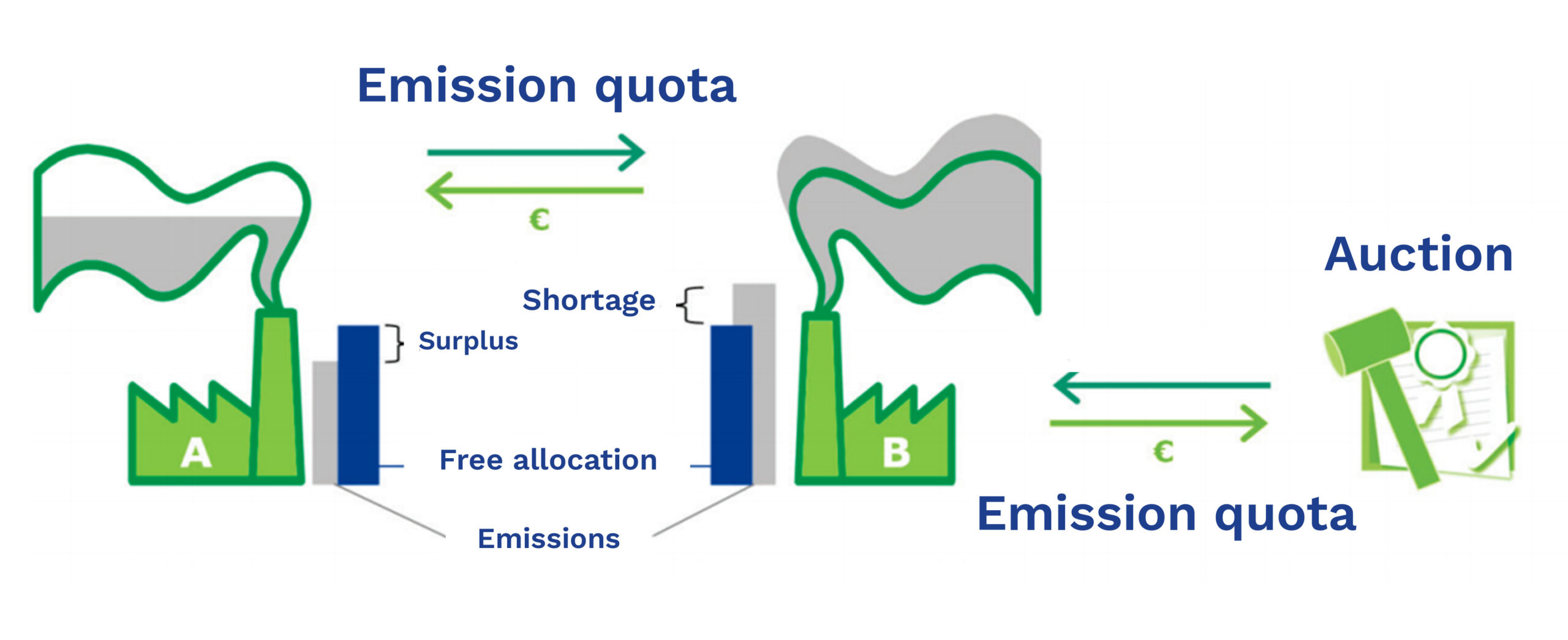

In practice, industries subject to the EU ETS must acquire emission allowances through auctions corresponding to their actual emissions, under penalty of fines. Some sectors are also allocated free allowances. Additionally, stakeholders have the option to trade allowances among themselves via an exchange. This is what we call the European CO2 market. .

The operational principle of the EU ETS

Source: European Court of Auditors

The EU ETS covers approximately 40% of the EU’s emissions, with nearly 10,000 installations subject to it. In France, 1,059 installations are included in the scheme, accounting for around 80 million tonnes of CO₂ emissions. (data as of 2022).

In May 2023, a reform of the mechanism was adopted by Europe. Its goal is to tighten the system’s provisions in line with the EU’s ambition to reduce greenhouse gas emissions by 55% by 2030 (compared to 1990 levels). One of the key aspects of the reform is to broaden the scope of sectors covered by the system. It provides for the inclusion of the building and road transport sectors (and other sectors not covered by the current mechanism) into a distinct system, commonly referred to as EU ETS 2, starting in 2025 with an adaptation phase of approximately two years. After this period, EU ETS 2 is expected to be fully operational and to allow for the trading of allowances.

For stakeholders already subject to the EU ETS, namely industrial operators, the reform includes significant changes with substantial consequences. Three measures will thus have a major impact in the medium term:

- The reduction in the number of allowances issued each year.

- The end of free emission allowances.

- The Carbon Border Adjustment Mechanism (CBAM).

The significant reduction in the number of allowances issued each year

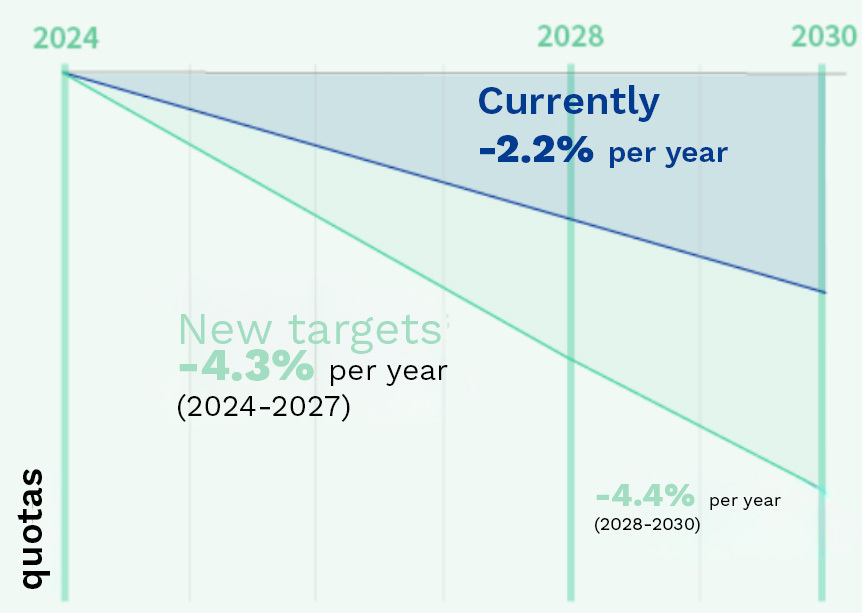

Pollution permits are regularly auctioned by European states. The number of allowances released onto the market each year is decreasing in line with European decarbonization goals. Since 2021, the annual reduction rate has been 2.2%. Under the system reform, this annual reduction rate has been increased to 4.3% from 2024 to 2027 and to 4.4% from 2028 to 2030, which is double the initially planned rate.

Evolution of the Reduction in the Number of Allowances

Source: European Commission

The reform of the EU ETS mechanism aims to allocate 100% of auction revenues towards climate-related expenditures (such as energy renovation).

2.1 billion euros

The revenue generated from the sale of allowances in France in 2023

Source: Ministry of Ecological Transition

The end of free allowances

A significant portion of allowances is allocated for free to industries exposed to a risk of carbon leakage, which, according to the European Parliament, refers to the relocation of greenhouse gas-emitting industries outside the EU to avoid stricter standards. Indeed, there may be a strong temptation for an industrial operator to relocate production to maintain competitiveness.

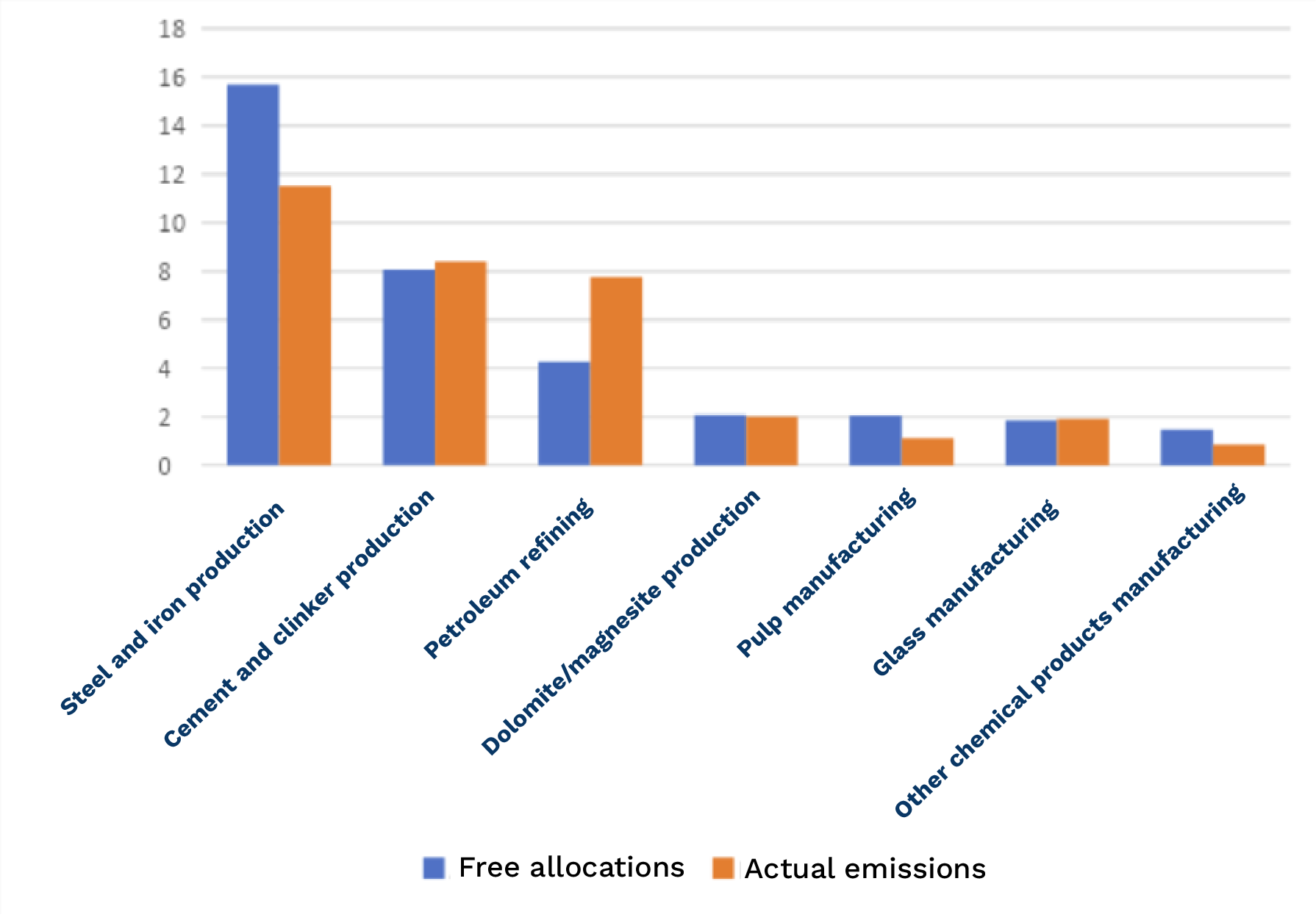

In 2023, free allocation accounted for nearly half of the allowances issued in Europe. Only electricity production does not receive any free allowances. More than sixty sectors and sub-sectors can benefit from these free allowances. The EU aims to end these free allocations, which account for the vast majority of emissions, and in some years and industrial sectors, even more.

Free Allocation of Emission Allowances and Actual Emissions of Key Sectors in 2023

(in millions of tonnes of CO₂ equivalent)

Source: European Environment Agency

The end of free allowances will occur gradually starting from 2026 to give industries time to adapt. The process will continue until 2034. This transition will result in an increase in production costs, which will vary depending on the sector (and the price of CO₂ at that time).

The CBAM for fair competition

Alongside the end of free allowances, the Carbon Border Adjustment Mechanism (CBAM) will be gradually implemented. This mechanism aims to protect the competitiveness of European industry by applying the CO₂ price to imported products. 2 to products imported from non-EU countries based on their carbon content. If there is already a CO2 in the exporting country, only the difference between that price and the CO₂ price in Europe will need to be compensated.

Initially, to limit the complexity of the mechanism, the CBAM will apply only to a limited list of products: steel, cement, aluminum, nitrogen fertilizers, and hydrogen. The production of these goods accounts for about half of the EU’s industrial emissions. Electricity production will also be covered.

The implementation is gradual, starting with a transition period that began the first

October 1, 2023, and will end on December 31, 2025. During this phase, importing companies of the targeted products must declare the volume of their imports and the associated greenhouse gas emissions. This transition period is intended to allow stakeholders (importers, producers, and authorities) to become familiar with the system and refine its details.

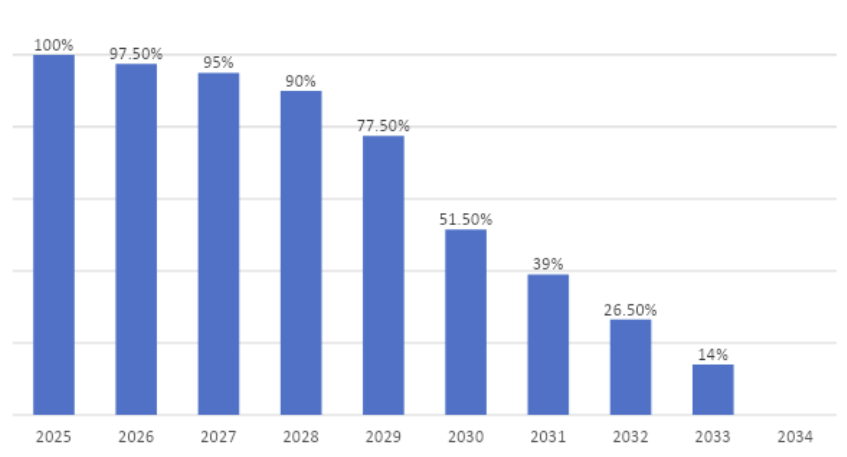

Starting in 2026, the operational period will commence. Importers of the targeted goods will then need to purchase CBAM certificates at the average price determined on the quota market. Initially, only a fraction of the emissions from imported products will need to be covered by the purchase of CBAM certificates. This proportion will increase until it reaches 100% by 2034. The rate of this increase corresponds to the phase-out of free allowances. The two measures are closely linked so that European industries no longer receiving free allowances can maintain their competitiveness against imports of competing products.

Scheduled Reduction of Free Emission Allowances for Sectors Covered by the CBAM

Source: Ministry of Ecological Transition

The reduction in the number of free emission allowances allocated, and thus the proportion of imports requiring the acquisition of CBAM certificates, will accelerate throughout the second phase of the system.

To avoid bearing the increasing burden of carbon constraints, industrial operators have only one option: to decarbonize their processes.